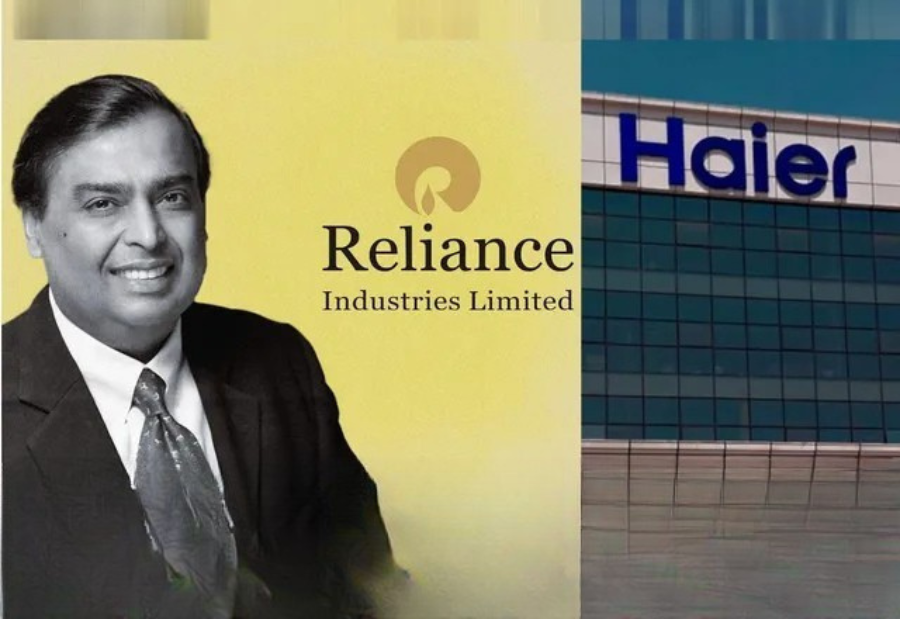

In a fresh chapter of corporate rivalry, Mukesh Ambani’s Reliance Industries is now facing off once again with Sunil Mittal’s Bharti Group, this time not in telecom but in the race to secure a strategic slice of Chinese electronics giant Haier’s Indian business. The competition echoes their long-standing clash in India’s digital sector and now finds its new battlefield in consumer electronics.

Haier Appliances India, the country’s third-largest home appliances brand after LG and Samsung, is on the lookout for an Indian partner as it considers offloading 25 to 51 percent of its equity. The aim is to deepen its local roots, possibly by adopting a structure similar to MG Motors, where an Indian firm becomes the lead stakeholder. Valuation talks hover between $2 billion and $2.3 billion, including a control premium. The company has been working with Citi since late 2023 to find the right investor.

The contenders are many. Apart from Reliance and the Bharti-led group, players like TPG with the Burman family, Goldman Sachs with the Jatia family, and GIC teamed up with Welspun’s BK Goenka are also in the running. Meanwhile, the Dalmia Bharat-Bain Capital combine has reportedly stepped away from the deal.

Driven by former US President Donald Trump’s tariff policies and India’s strict FDI rules under Press Note 3, Chinese firms like Haier are increasingly leaning on Indian alliances to scale locally. Haier’s ₹1,000 crore FDI proposal from 2023 is still pending government nod. In the meantime, it eyes equity dilution of about 45 to 48 percent to a domestic partner, with up to 6 percent reserved for employees and distributors.

Sources say Reliance, a late but ambitious entrant, reached out directly to Haier’s Qingdao HQ and is likely to front the bid through its retail arm. “Reliance was a late entrant but is keen to expand its own-brand electronics play, like its FMCG push with Campa Cola,” a person close to the matter shared. The conglomerate plans to use its portfolio brands like BPL, Reconnect, Kelvinator, and Wyzr to enhance its electronics foothold, despite mixed past results.

Haier, which reported a sharp 33 percent jump in revenue to ₹8,900 crore in 2024, is eyeing ₹11,500 crore in 2025. However, expansion blueprints, including new factories in Greater Noida, Pune, and the South, are frozen due to policy bottlenecks.

Interestingly, insiders believe Reliance may also be leveraging delays in LG’s IPO to push for a more favorable valuation. RIL’s evolving approach toward Chinese tie-ups, evident in its Shein partnership and clean energy plans, reflects a wider strategy of calculated collaboration in an increasingly complex geopolitical climate.

Also read: Viksit Workforce for a Viksit Bharat

Do Follow: The Mainstream formerly known as CIO News LinkedIn Account | The Mainstream formerly known as CIO News Facebook | The Mainstream formerly known as CIO News Youtube | The Mainstream formerly known as CIO News Twitter |The Mainstream formerly known as CIO News Whatsapp Channel | The Mainstream formerly known as CIO News Instagram

About us:

The Mainstream formerly known as CIO News is a premier platform dedicated to delivering latest news, updates, and insights from the tech industry. With its strong foundation of intellectual property and thought leadership, the platform is well-positioned to stay ahead of the curve and lead conversations about how technology shapes our world. From its early days as CIO News to its rebranding as The Mainstream on November 28, 2024, it has been expanding its global reach, targeting key markets in the Middle East & Africa, ASEAN, the USA, and the UK. The Mainstream is a vision to put technology at the center of every conversation, inspiring professionals and organizations to embrace the future of tech.