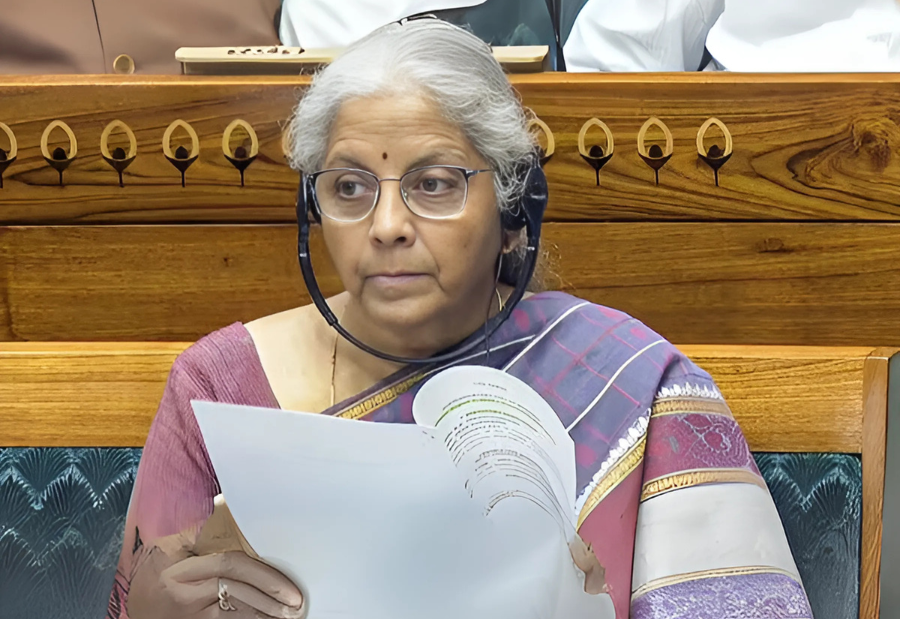

Finance Minister Nirmala Sitharaman on Monday introduced the Taxation Laws Amendment Bill 2025 in the Lok Sabha, proposing specific changes to India’s direct tax framework. The Bill focuses on pension-related relief, revisions to search-linked “block assessment” rules, and targeted tax benefits for Saudi Arabia’s sovereign wealth capital.

A key provision seeks to align the tax treatment of the government’s new Unified Pension Scheme with the existing National Pension System. The Unified Pension Scheme, officially notified on 24 January 2025, came into effect on 1 April 2025 following operational guidelines from the pension regulator. The amendment aims to clarify the tax treatment of lump sum payouts and other benefits for scheme subscribers.

On the international investment front, the Bill proposes to extend direct tax exemptions to Saudi Arabia’s Public Investment Fund and its eligible subsidiaries under the category of specified long-term investors. This move is intended to attract greater sovereign wealth and pension fund investments into infrastructure and related sectors. It follows recent policy measures to relax foreign portfolio investment rules for Public Investment Fund entities, enabling them to hold larger stakes in Indian companies.

The Bill also addresses technical aspects of the block assessment process used after tax searches and requisitions. Building on changes introduced in the Finance Act 2025, the amendments aim to streamline timelines and procedures, focusing solely on undisclosed income found during searches. This is expected to reduce overlap with regular assessments and minimise litigation.

The pension-related changes come as the government positions the Unified Pension Scheme as an optional pathway within the National Pension System for Central government employees. Ministries have been rolling out enrolment and migration instructions throughout the first half of the current financial year. Ensuring clarity in income tax rules for lump sum pension amounts has been a long-standing demand to align retiree benefits with policy objectives.

Presenting the Bill, the Finance Minister described the proposals as “limited, purpose-built amendments” rather than a restructuring of tax rates or slabs, consistent with the 2025 Budget’s incremental approach. The Bill will now be taken up for debate in the Lok Sabha before moving to the Rajya Sabha.

Also read: Viksit Workforce for a Viksit Bharat

Do Follow: The Mainstream formerly known as CIO News LinkedIn Account | The Mainstream formerly known as CIO News Facebook | The Mainstream formerly known as CIO News Youtube | The Mainstream formerly known as CIO News Twitter |The Mainstream formerly known as CIO News Whatsapp Channel | The Mainstream formerly known as CIO News Instagram

About us:

The Mainstream formerly known as CIO News is a premier platform dedicated to delivering latest news, updates, and insights from the tech industry. With its strong foundation of intellectual property and thought leadership, the platform is well-positioned to stay ahead of the curve and lead conversations about how technology shapes our world. From its early days as CIO News to its rebranding as The Mainstream on November 28, 2024, it has been expanding its global reach, targeting key markets in the Middle East & Africa, ASEAN, the USA, and the UK. The Mainstream is a vision to put technology at the center of every conversation, inspiring professionals and organizations to embrace the future of tech.