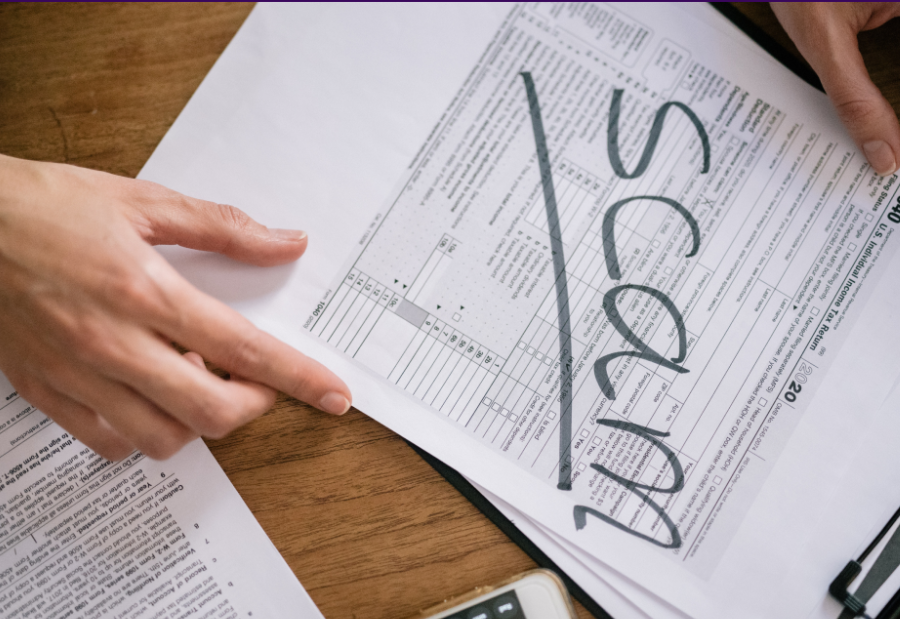

For years, financial institutions have fought fraud involving fake documents like altered pay stubs and false employment records. But now a more complex scheme is emerging: circular income transactions. This method involves people moving money through platforms such as Venmo or Cash App. The cash briefly appears in their bank accounts, making it look like regular deposits during statement periods. Before lenders or automated systems notice, the money is quickly moved out again – often to another personal account, a friend, or back through the same app. This creates a closed loop of transactions, a type of synthetic income laundering that falsely boosts an applicant’s earnings.

The challenge with this fraud is that it looks legitimate on the surface. Unlike fake documents or employers, circular income uses real transactions shown on genuine bank statements and processed by trusted financial platforms. This makes it very hard for traditional automated income verification tools to detect. These systems often cannot analyze the timing, frequency, and quick reversals of funds. As a result, borrowers committing this fraud may be wrongly seen as “qualified,” exposing lenders to serious risk. This problem affects all economic groups and areas, driven by rising living costs such as car prices, interest rates, and insurance. Borrowers use these digital tricks to make their loan applications appear stronger.

Financial firms have long relied on fraud consortia to spot suspicious patterns. However, sharing detailed financial data raises privacy concerns, regulatory issues, and legal risks. Many lenders hesitate to join fully, fearing misuse of data or exposure of sensitive information. Experts say the answer is not to stop collaboration but to modernize it. The focus should be on “fraud intelligence exchanges” – privacy-safe, opt-in systems that detect unusual behavior without sharing consumer data directly. This could include tokenized intelligence or outcome-based alerts. For circular transactions, the key signs are not amounts but the speed and reversibility of funds. AI-powered tools designed to spot digital behaviours are better suited to this task.

Stopping these new fraud types requires a shift to multi-layered detection beyond simple reviews or basic automation. This includes techniques like:

– Anomalous collision detection to flag unusual identifier combinations across documents

– Fraudulent template recognition comparing documents to known fake layouts

– Metadata analysis to find signs of editing or tampering

– Even small formatting inconsistencies can be warning signs.

Fraud today is not just fake documents but manipulation of real digital records. Circular transactions show this clearly – the deposits are real, but the intent and unusual behaviour reveal the fraud. Without advanced tools analysing this context, these schemes will go unnoticed. This is more than compliance; it threatens profits through early loan defaults and loss of trust in automated lending. Lenders must invest in tools that analyse bank data, track transaction flows, and flag anomalies in real time. Synthetic income hides in real cash flow, driven by intent and disguised by digital legitimacy. To fight it, the industry must think as creatively as the fraudsters themselves.

Also read: Viksit Workforce for a Viksit Bharat

Do Follow: The Mainstream formerly known as CIO News LinkedIn Account | The Mainstream formerly known as CIO News Facebook | The Mainstream formerly known as CIO News Youtube | The Mainstream formerly known as CIO News Twitter |The Mainstream formerly known as CIO News Whatsapp Channel | The Mainstream formerly known as CIO News Instagram

About us:

The Mainstream formerly known as CIO News is a premier platform dedicated to delivering latest news, updates, and insights from the tech industry. With its strong foundation of intellectual property and thought leadership, the platform is well-positioned to stay ahead of the curve and lead conversations about how technology shapes our world. From its early days as CIO News to its rebranding as The Mainstream on November 28, 2024, it has been expanding its global reach, targeting key markets in the Middle East & Africa, ASEAN, the USA, and the UK. The Mainstream is a vision to put technology at the center of every conversation, inspiring professionals and organizations to embrace the future of tech.