Eight venture capital and private equity firms from the United States and India have joined hands to launch a $1 billion-plus alliance aimed at funding Indian deep tech startups over the next decade. The coalition, named the India Deep Tech Investment Alliance, includes Accel, Blume Ventures, Celesta Capital, Premji Invest, Gaja Capital, Ideaspring Capital, Tenacity Ventures, and Venture Catalysts.

The alliance is seen as a direct response to concerns about limited funding for deep tech in India. Earlier this year, Commerce Minister Piyush Goyal drew criticism for saying Indian startups were focusing on food delivery instead of innovation, comparing them unfavourably with Chinese firms. Many founders and investors argued that India lacked capital for deep tech ventures. The new alliance seeks to address these gaps by pooling long-term private funding and supporting startups that have struggled to raise resources.

The move is unusual because investors typically compete for deals rather than formally band together under a single platform. Under the agreement, each member will commit private capital over a five to ten-year period to India-domiciled deep tech ventures. New Delhi has already mandated local incorporation for companies that wish to benefit from incentives under its recently approved ₹1 trillion Research, Development, and Innovation scheme.

“This is in line with the strategic interests of both India and the U.S. at the governmental level, focusing on critical and emerging technologies,” said Arun Kumar, managing partner at Celesta Capital, who will serve as the inaugural chair of the alliance.

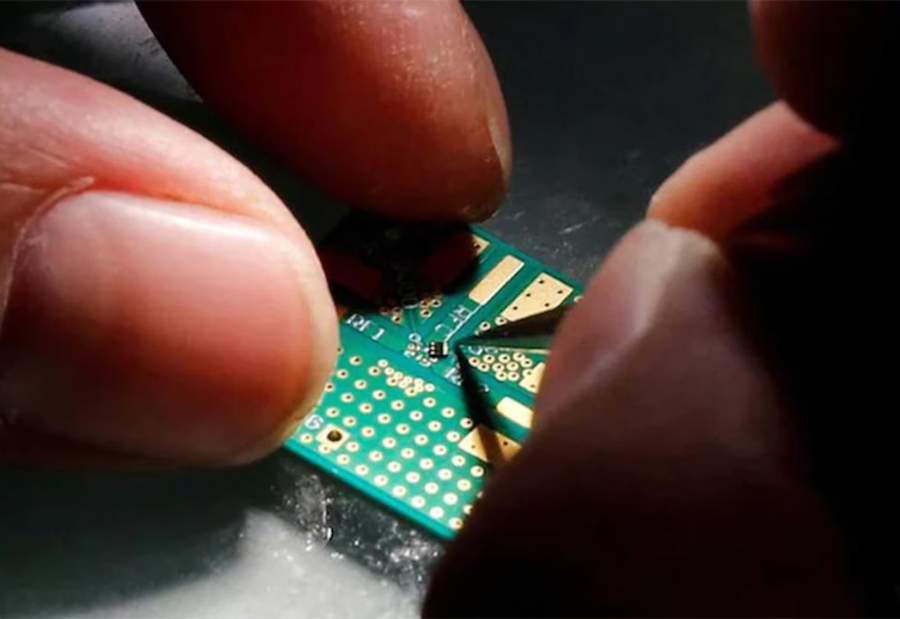

Despite trade tensions between the two countries, including recent tariffs imposed by the U.S., the alliance is betting on India’s potential as a hub for technologies such as artificial intelligence, semiconductors, quantum computing, robotics, biotech, energy, and climate tech.

Celesta Capital, an early investor in Indian firms such as Agnikul, IdeaForge, and OneCell Diagnostics, spearheaded the effort with support from industry stakeholders and the government. The alliance will target early-stage investments from seed to Series B while avoiding late-stage deals.

An advisory committee with representatives from Accel, Premji Invest, and Venture Catalysts will help align objectives while each fund maintains independence. The group also plans to work with the government on policy and incentives, ensuring industry interests are represented.

“Over the next decade, startups will build in India and export breakthrough solutions to the world. The tailwinds are in place: ambition, talent, policy intent, and patient capital,” said Anand Daniel, partner at Accel.

Also read: Viksit Workforce for a Viksit Bharat

Do Follow: The Mainstream formerly known as CIO News LinkedIn Account | The Mainstream formerly known as CIO News Facebook | The Mainstream formerly known as CIO News Youtube | The Mainstream formerly known as CIO News Twitter |The Mainstream formerly known as CIO News Whatsapp Channel | The Mainstream formerly known as CIO News Instagram

About us:

The Mainstream formerly known as CIO News is a premier platform dedicated to delivering latest news, updates, and insights from the tech industry. With its strong foundation of intellectual property and thought leadership, the platform is well-positioned to stay ahead of the curve and lead conversations about how technology shapes our world. From its early days as CIO News to its rebranding as The Mainstream on November 28, 2024, it has been expanding its global reach, targeting key markets in the Middle East & Africa, ASEAN, the USA, and the UK. The Mainstream is a vision to put technology at the center of every conversation, inspiring professionals and organizations to embrace the future of tech.