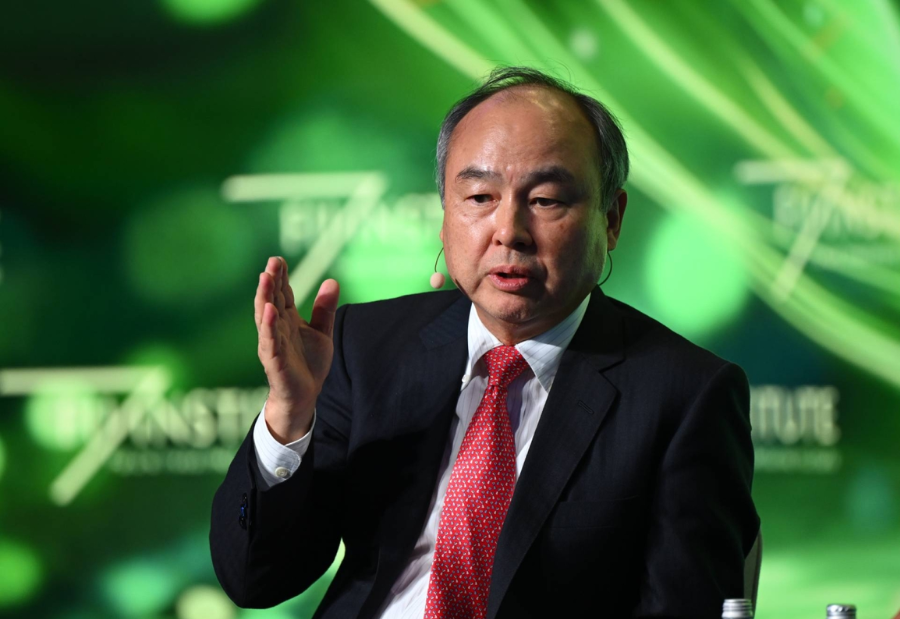

After months of negotiations, SoftBank Group has stopped discussions to acquire US data center operator Switch Inc., according to people familiar with the matter. The move marks a pause in founder Masayoshi Son’s plan to expand large-scale AI infrastructure in the United States.

The proposed transaction, valued at around $50 billion, would have been one of SoftBank’s largest acquisitions. Masayoshi Son believed that owning Switch’s energy-efficient data center network could support Donald Trump’s $500 billion Stargate project by providing computing power for partner OpenAI. Analysts said the deal could have strengthened efforts to build new US data centers under the Stargate initiative.

In January 2025, shortly after Donald Trump’s swearing-in, SoftBank pledged to deploy $100 billion “immediately” alongside OpenAI, Oracle, and Abu Dhabi’s MGX. However, earlier this month, Masayoshi confirmed that a full takeover of Switch was no longer being pursued and cancelled a planned January announcement.

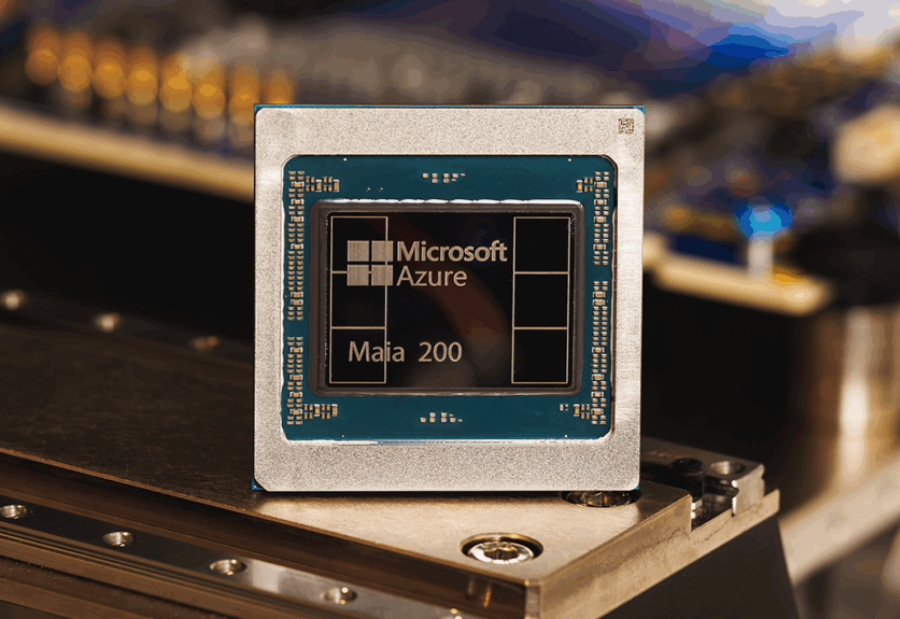

“The end of SoftBank’s deal talks with Switch leaves its data center plans in limbo, as Stargate announcements remain few and far between,” wrote analysts Kirk Boodry and Chris Muckensturm in a note. They added that a partnership or minority investment would not provide the same operational control SoftBank seeks in areas such as semiconductors and physical AI.

Despite dropping the full acquisition, the 2 companies are still reported to be in discussions about a partial investment or strategic partnership. Some within SoftBank were concerned about the size of the deal and the challenge of managing data center campuses across locations from Las Vegas to Atlanta.

Over the past 1 year, SoftBank has sharply increased its focus on artificial intelligence. The Tokyo-based group took an 11% stake in OpenAI, investing $22.5 billion in December 2025. It also acquired US chip designer Ampere Computing for $6.5 billion and announced a $5.4 billion deal to buy ABB Ltd.’s robotics unit.

To fund these moves, SoftBank has sold part of its T-Mobile US stake and exited its Nvidia holding to support its OpenAI investment. The company is also exploring further liquidity options, including possible asset sales, a PayPay IPO, and margin loans backed by its Arm Holdings Plc stake, as it concentrates resources on AI infrastructure projects.

Also read: Viksit Workforce for a Viksit Bharat

Do Follow: The Mainstream formerly known as CIO News LinkedIn Account | The Mainstream formerly known as CIO News Facebook | The Mainstream formerly known as CIO News Youtube | The Mainstream formerly known as CIO News Twitter

About us:

The Mainstream is a premier platform delivering the latest updates and informed perspectives across the technology business and cyber landscape. Built on research-driven, thought leadership and original intellectual property, The Mainstream also curates summits & conferences that convene decision makers to explore how technology reshapes industries and leadership. With a growing presence in India and globally across the Middle East, Africa, ASEAN, the USA, the UK and Australia, The Mainstream carries a vision to bring the latest happenings and insights to 8.2 billion people and to place technology at the centre of conversation for leaders navigating the future.